Home loan calculators and tools

Table of Content

Home loan cashback promotion is available to Australian residents aged 18+ who refinance a property with a new Bankwest home loan. How often you will be making your payments – weekly, fortnightly or monthly. We’re on a mission to deliver the most competitive home loan rates on the market!

Increasing the frequency of your repayments can help you pay less interest over the life of the loan. You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan. Business Optimiser High variable interest business savings account with 24/7 access.Business Term Deposit High fixed interest rate for business savings. You choose the timeframe.Wholesale Term Deposit Competitive interest rates for a fixed period, that's tailored to your cash flow needs.

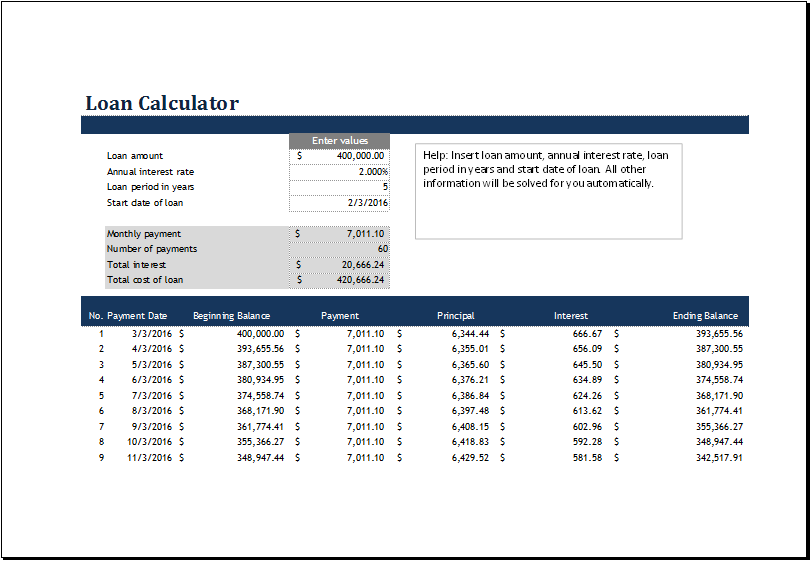

Mortgage Repayment Calculator

By paying extra, you could reduce your loan term by 0 year 0 month and save $0.00 in interest. If you’re making interest only repayments then you’re only paying down the interest on your loan for a set period of time, usually one to five years. When you repay interest only, the total amount borrowed will not reduce. Use our extra repayment calculator to see how much quicker you can own your property outright. Budget calculator will also help you work out how much additional repayments you can make towards your loan.

There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments. For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions. 8 Years As we can see by making an extra payment of $300 each month, the borrower saves about $9,423.35 in interest payment, and he pays off his loan in 8 years instead of 10. Minimum $1,000 withdrawal with a $0 Redraw fee over the counter at any Commonwealth Bank branch and no minimum electronically with a $0 Redraw fee. Redraw and Repayment Holiday are dependent on having the required amount available in special repayments .

Mortgage Calculator With Extra Payments

They are calculated based on our current advertised variable rate, and assume this rate continues for the life of the loan. Compare repayments between principal and interest, and interest only options, or find the total cost of these loans. Calculate your standard repayments based on interest rate and loan term.

Our home loan extra repayment & lump sum payment calculator can show you just how much difference extra repayments can make to your overall loan. This page will tell you how much you can save by making extra repayments into your offset account. Paying off your mortgage early may save you thousands of dollars in interest and may shave years off of your mortgage. It may be worth considering paying off your mortgage early if your lender allows for extra repayments without penalty.

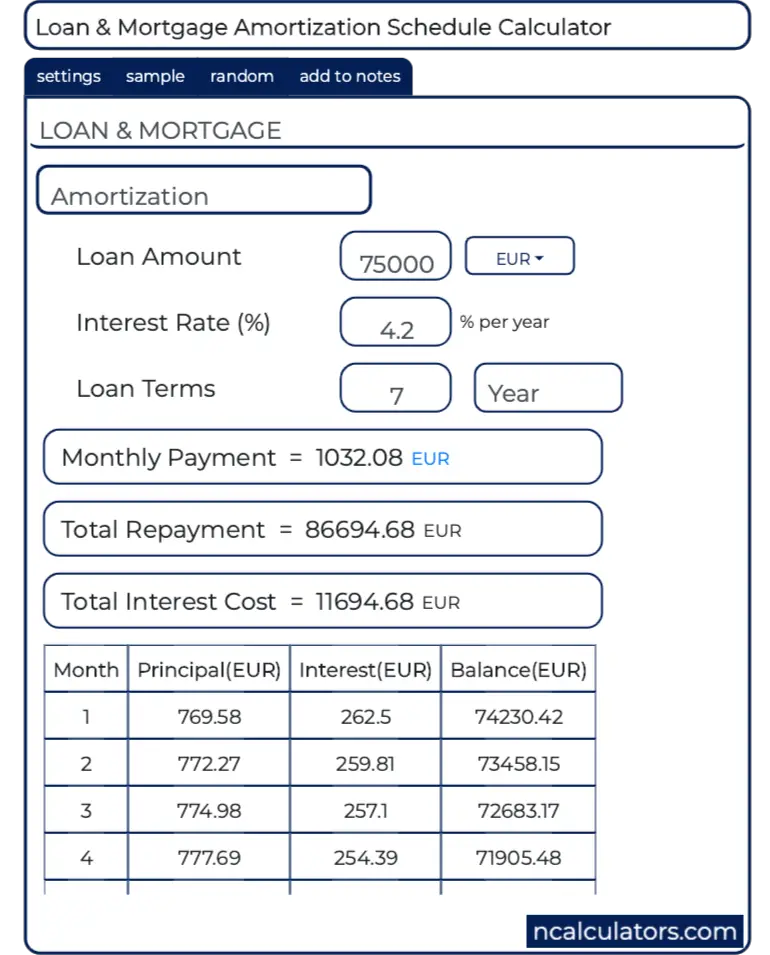

How the extra and lump sum calculator works

Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

Compare today's lowest home loan rates & repayments from over 60 banks and specialty lenders. If your circumstances change unexpectedly, accessing additional home loan repayments you’ve made could be an option. If you have a 30-year $250,000 mortgage with a 5 percent interest rate, you will pay $1,342.05 each month in principal and interest alone.

Save a lot by paying just a little extra

It cannot be established in the name of a business or family investment trust. Trust loans can however be linked to the trustee package where the trustee is an applicant (i.e. the borrower) on the loan. For example, a loan held in the name of “John Smith ITF The Smith Family Trust” can have a package established in the name of John Smith as the trustee. Estimate the other costs of buying a property, including government costs, stamp duty, and fees. Digital lender Athena has altered its variable home loan products, launching ‘Straight Up’ and ‘Power Up’ home loans.

Whether you can contribute one larger lump sum or extra repayments over time will depend on you. Additional repayments will be made on top of your standard monthly repayment of $100 each month. An extra $10,000 will be contributed in the sixth month of your loan term. We can help you understand how your repayments could change if you choose to pay principal and interest or interest only, as well as how much you could save by making extra repayments. The extra repayment calculator will work out the length of your new mortgage term and the total amount that you will save.

For the Rate Buster Variable where the borrower pays an upfront fee of $150 then a corresponding loyalty discount of 0.05% p.a. Off the Rate Buster Variable rate will automatically apply after the 5th anniversary of the loan. For the Investor Rate Buster Variable where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.08% p.a.

If you’re considering making $300 extra monthly repayments, but the penalty is $350, you might decide it isn’t worth it for you. You could consider refinancing and switching to a home loan without extra repayment penalties, but this will come down to your own individual circumstances. Making extra repayments is a great way to pay off your mortgage sooner. Even small, frequent additional repayments can have a huge impact. Some home loans, generally fixed, allow you make extra repayments up to a certain amount and others, generally variable, allow you to make unlimited repayments. If you are disciplined with your money then it is better to make those extra payments to your offset account.

At this point, additional repayments will often be accepted. But in most cases, making extra repayments on a fixed loan will lead to you breaking your agreement - and this can be expensive. If your lender has extra repayment penalties, you might want to consider whether making additional repayments will end up being cost effective.

Comments

Post a Comment